Chapter 13. Time Series Analysis

CHAPTER OBJECTIVES

In this chapter, we study data observed over time, time series, and introduce about:

--- What is time series analysis and what are the types of time series models?

--- How to smooth a time series.

--- How to transform a time series.

--- Prediction method using regression model.

--- Prediction method using exponential smoothing model.

--- Prediction method for seasonal time series.

We will be mainly focused on descriptive methods and simple models, and discussion of the Box-Jenkins model and other theoretical models will not be discussed.

13.1 What is Time Series Analysis?

Time series refers to data recorded according to changes in time. In general, observations are made at regular time intervals such as year, season, month, or day, and this is called a

discrete time series. There may be time series that are continuously observed, but this book will only deal with the analysis of discrete time series.

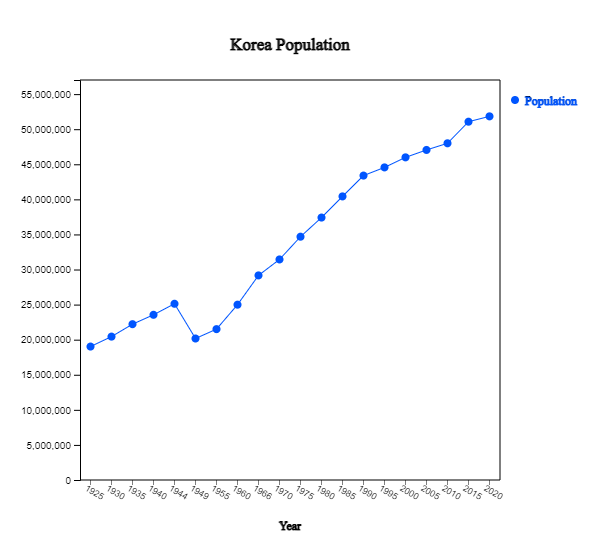

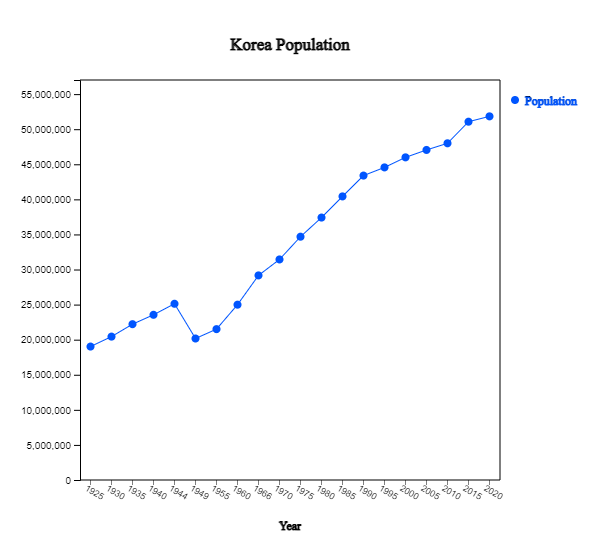

An example of a discrete time series is the population of Korea as shown in [Table 13.1.1]. This data is from the census conducted every five years in Korea from 1925 to 2020 (except for 1944 and 1949).

[Table 13.1.1] Population of Korea

| Year |

Population |

1925

1930

1935

1940

1944

1949

1955

1960

1966

1970

1975

1980

1985

1990

1995

2000

2005

2010

2015

2020

|

19020030

20438108

22208102

23547465

25120174

20166756

21502386

24989241

29159640

31435252

34678972

37406815

40419652

43390374

44553710

45985289

47041434

47990761

51069375

51829136

|

As shown in the table above, it is not easy to understand the overall shape of the time series displayed in numbers. The first step in time series analysis is to observe the time series by drawing a time series plot with the X axis as time and the Y axis as time series values. For example, the time series plot of the total population in Korea is shown in <Figure 13.1.1>.

<Figure 13.1.1>Time Series of Korea Population

|

Observing this figure, Korea's population has an overall increasing trend, but the population decreased sharply

in 1944-1949 due to World War II. It can be seen that the population expanded rapidly after the Korean war in 1953

and slowed since 1990. It can also be seen that the growth has slowed further in the last 10 years. By observing

the time series in this way, trends, change points, and outliers can be observed, which is helpful in selecting an analysis model or method suitable for the data.

Time series that we frequently encounter include monthly sales of department stores and companies, daily composite stock index, annual crop production, yearly export and import time series, and yearly national income and economic growth rate, and so on.

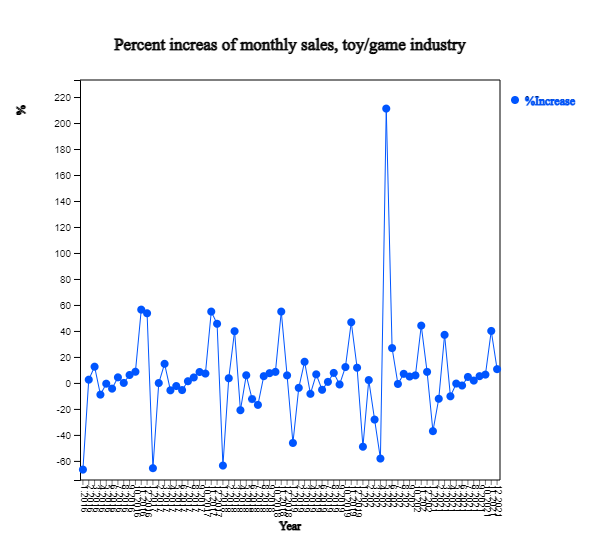

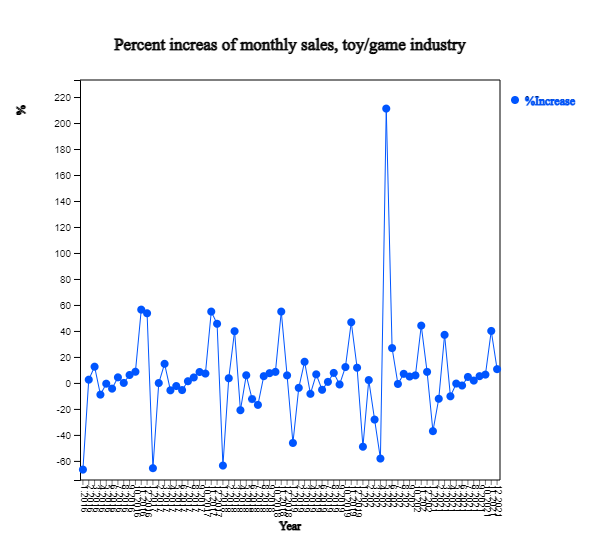

[Table 13.1.2] shows the percent increase in monthly sales of the US toy/game industry for the past 6 years, and <Figure 13.1.2> is a plot of this time series. As it is the rate of change from the previous month, it can be observed that it is seasonal data showing a large increase in November and December every year, moving up and down based on 0. However, May 2020 is an extreme with an increase rate of 211% unlike other years. For time series, you can better examine the characteristics of the data by converting the raw time series into the rate of change.

[Table 13.1.2] Percent Increase, Monthly Sales of Toy/Game in US(%) (Source: Bureau of Census, US)

| Year.month |

Percent Increase |

2016.01

2016.02

2016.03

2016.04

2016.05

2016.06

2016.07

2016.08

2016.09

2016.10

2016.11

2016.12

2017.01

2017.02

2017.03

2017.04

2017.05

2017.06

2017.07

2017.08

2017.09

2017.10

2017.11

2017.12

2018.01

2018.02

2018.03

2018.04

2018.05

2018.06

2018.07

2018.08

2018.09

2018.10

2018.11

2018.12

2019.01

2019.02

2019.03

2019.04

2019.05

2019.06

2019.07

2019.08

2019.09

2019.10

2019.11

2019.12

2020.01

2020.02

2020.03

2020.04

2020.05

2020.06

2020.07

2020.08

2020.09

2020.10

2020.11

2020.12

2021.01

2021.02

2021.03

2021.04

2021.05

2021.06

2021.07

2021.08

2021.09

2021.10

2021.11

2021.12

|

-66.7

2.5

12.5

-9.0

-0.6

-4.4

4.3

0.0

6.1

8.6

56.4

53.6

-65.6

-0.1

14.7

-5.7

-2.4

-5.5

1.3

4.2

8.4

7.2

54.9

45.5

-63.6

3.6

39.8

-21.0

5.9

-12.4

-16.9

5.2

7.5

8.5

54.9

5.8

-46.2

-3.8

16.3

-8.4

6.6

-5.3

0.8

7.7

-1.2

12.2

46.7

11.7

-49.1

2.2

-28.2

-58.2

211.1

26.8

-0.8

7.0

4.9

5.8

44.1

8.5

-37.1

-12.2

37.0

-10.3

-0.5

-2.0

4.6

1.8

5.2

6.4

40.0

10.6

|

<Figure 13.1.2>Percent Increase, Monthly Sales of Toy/Game in US(%)

|

Most time series have four components: trend, seasonal, cycle, and other irregular factors.

Trend is a case in which a time series has a certain trend, such as a line or a curved shape

as time elapses, and there are various types of trends. Trends can be understood as a consumption behavior,

population variations, and inflation that appear in time series over a long period of time.

Seasonal factors are short-term and regular fluctuation factors that exist quarterly, monthly,

or by day of the week. Time series such as monthly rainfall, average temperature, and ice cream sales

have seasonal factors. Seasonal factors generally have a short cycle, but fluctuations when the cycle

occurs over a long period of time rather than due to the season is called a cycle factor. By observing

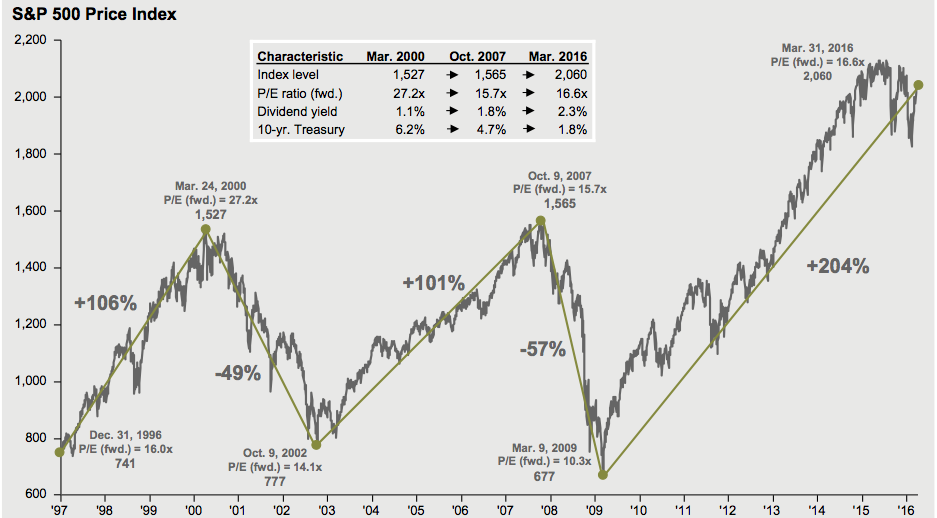

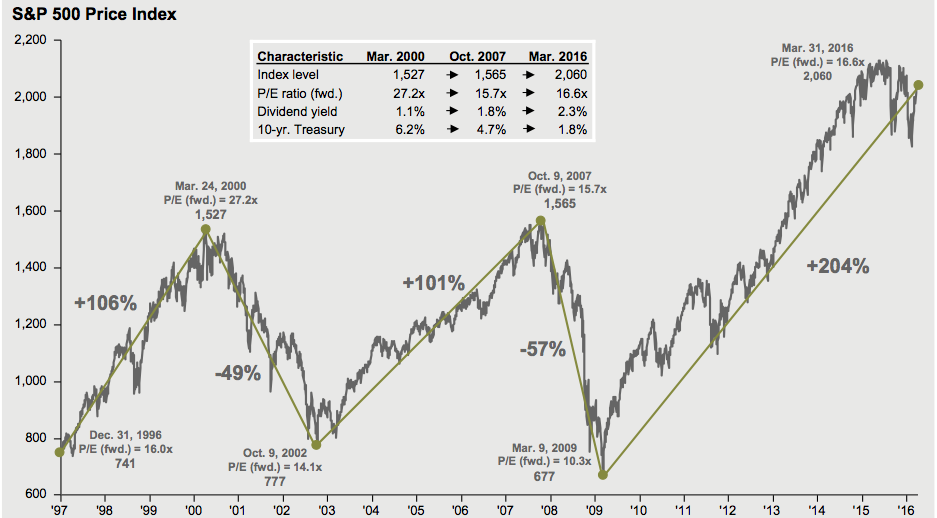

these cyclical factors, it is possible to predict the boom or recession of a periodic economy. <Figure 13.1.3> shows the US S&P 500 Index from 1997 to 2016, and a six-year cycle can be observed.

<Figure 13.1.3>] US S&P500 Index (1997- 2016)

|

Other factors that cannot be explained by trend, season, or cyclical factors are called irregular

or random factors, which refer to variable factors that appear due to random causes regardless of regular movement over time.

13.1.1 Time Series Model

By observing the time series, you can predict how this time series will change in the future by building a time series model that fits the probabilistic characteristics of this data. Because the time series observed in reality has a very diverse form, the time series model is also very diverse, from simple to very complex. In general, time series models for a single variable can be divided into the following four categories.

A. Regression Model

A model that explains data or predicts the future by expressing a time series in the form of

a function related to time is the most intuitive and easy to understand model. That is,

when a time series is an observation of a random variable, \(Y_1 , Y_2 , ... , Y_n\),

it is expressed as the following model:

$$

Y_t \;=\; f(t) \;+\; \epsilon _ t , \,\, t=1,2, ... , n

$$

Here \(\epsilon_t\) is the error of the time series that cannot be explained by a function \(f(t)\).

In general \(\epsilon_t\) is assumed independent, \(E(\epsilon_t ) = 0\) , and

\(Var(\epsilon_t ) = \sigma^2)\) which is called a white noise. For example, the following model

can be applied to a time series in which the data is horizontal or has a linear trend.

\( \qquad \text{Horizontal:} \qquad Y_t \;=\; \mu \;+\; \epsilon _ t \)

\( \qquad \text{Linear Trend:}\quad Y_t \;=\; a \;+\; b\, t \;+\; \epsilon _ t \)

B. Decomposition Model

The model that decomposes the time series into four factors, i.e., trend(\(T_t\)), cycle(\(C_t\)),

seasonal(\(S_t\)), and irregular(\(I_t\)), is an analysis method that has been used for a long time based on empirical facts. It can be divided into additive model and multiplicative model.

\( \qquad \text{Additive Model:} \qquad \qquad Y_t \;=\; T_t \;+\; C_t \;+\; S_t \;+\; I_t \)

\( \qquad \text{Multiplicative Model:}\qquad Y_t \;=\; T_t \;\times\; C_t \;\times\; S_t \;\times \; I_t \)

Here \(T_t\), \(C_t\), \(S_t\) are deterministic function, \(I_t\) is a random variable.

If we take the logarithm of a multiplicative model, it becomes an additive model.

If the number of data is not enough, the cycle factor can be omitted in the model.

C. Exponential Smoothing Model

Time series data are often more related to recent data than to past data. The above two types of models are models that do not take into account the relationship between the past time series data and the recent time series data. Models using moving averages and exponential smoothing are often used to explain and predict data using the fact that time series forecasting is more related to recent data.

D. Box-Jenkins ARIMA Model

The above models are not methods that can be applied to all types of time series, and the analyst selects and applies them according to the type of data. Box and Jenkins presented the following general ARIMA model that can be applied to all time series of stationary or nonstationary type as follows:

$$

Y _{t} \,=\, \mu \,+\, \phi_{1} \, Y _{t-1} \,+\, \phi _{2} \, Y_{t-2} \,+\, \cdots \,+\, \epsilon _{t} \,+\, \theta _{1} \, \epsilon _{t-1} \,+\, \theta _{2} \, \epsilon _{t-2} \,+\, \cdots

$$

The ARIMA model considers the observed time series as a sample extracted from a population time series, studies the probabilistic properties of each model, and establishes an appropriate time series model through parameter estimation and testing. For the ARIMA model, autocorrelation coefficients between time lags are used to identify a model. The ARIMA model is beyond the scope of this book, so interested readers are encouraged to consult the bibliography.

In the above time series model, the regression model and ARIMA model are systematic models based on statistical theory, and the decomposition model and exponential smoothing model are methods based on experience and intuition. In general, regression models using mathematical functions and models using decomposition are known to be suitable for predicting slow-changing time series, whereas exponential smoothing and ARIMA models are known to be effective in predicting very rapidly changing time series.

For all time series models, it is impossible to predict due to sudden changes. And because time series has so many different forms, it cannot be said that one time series model is always superior to another. Therefore, rather than applying only one model to a time series, it is necessary to establish and compare several models, combine different models, or make an effort to determine the final model by combining opinions of experts familiar with the time series.

13.1.2 Evaluation of Time Series Model

Let the time series be the observed values of the random variables \(Y_1 , Y_2 , ... , Y_n\)

and \(\hat Y_1 , \hat Y_2 , ... , \hat Y_n\) be the values predicted by the model.

If the model agrees exactly, the observed and predicted values are the same, and the model

error \(\epsilon_t\) is zero. In general, it is assumed that the error \(\epsilon_t\)’s of

the time series model are independent random variables which follow the same normal

distribution with a mean of 0 and a variance of \(\sigma^2\). The accuracy of a time series

model can be evaluated using residual, \(Y_t \,-\, {\hat Y}_t\), which is a measure by

subtracting the predicted value from the observed value. In general, the following mean squared error (MSE) is commonly used for the accuracy of a model and the smaller the MSE value, the more appropriate the predicted model is judged.

$$

{MSE} \,=\, \frac{ \sum_{t=1}^n \, ( Y_t\,-{\hat Y}_t \,)^{2} } {n}

$$

The mean square error is used as an estimator for the variance \(\sigma^2\) of the error \(\epsilon_t\).

Since MSE can have a large value, the root mean squared error (RMSE) is often used.

$$

{RMSE} \,=\, \sqrt{MSE }

$$

13.2 Smoothing of Time Series

Original time series data can be used to make a time series model by observing trends, but in many cases,

time series can be observed after smoothing to unerstand better. In a time series such as stock price, it is often difficult to find a trend because of temporary or short-term fluctuations due to accidental coincidences or cyclical factors. In this case, smoothing techniques are used as a method to effectively grasp the overall long-term trend by removing temporary or short-term fluctuations. The centered moving average method and the exponential smoothing method are widely used.

13.2.1 Centered Moving Average

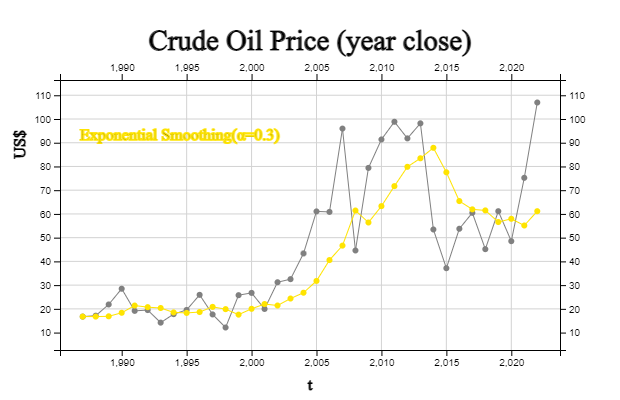

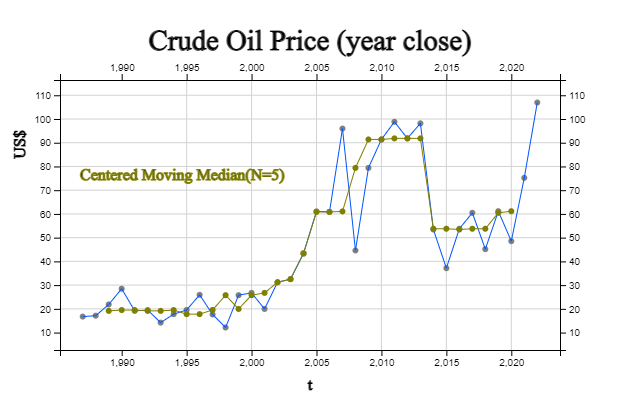

The time series in [Table 13.2.1] is the world crude oil price based on the closing price every year from 1987 to 2022. Looking at <Figure 13.2.1>, it can be seen that the short-term fluctuations in the time series are large. However, causes such as oil shocks are short-term and not continuous, so if we are interested in the long-term trend of gasoline consumption, it would be more effective to look at the fluctuations caused by short-term causes.

[Table 13.2.1] Price of Crude Oil (End of Year Price, US$) and 5-point Centered Moving Average

| Year |

Price of Oil |

5-point Centered Moving Average |

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

|

16.74

17.12

21.84

28.48

19.15

19.49

14.19

17.77

19.54

25.90

17.65

12.14

25.76

26.72

19.96

31.21

32.51

43.36

61.06

60.85

95.95

44.60

79.39

91.38

98.83

91.83

98.17

53.45

37.13

53.75

60.46

45.15

61.14

48.52

75.21

106.95

|

---

---

20.666

21.216

20.630

19.816

18.028

19.378

19.010

18.600

20.198

21.634

20.446

23.158

27.232

30.752

37.620

45.798

58.746

61.164

68.370

74.434

82.030

81.206

91.920

86.732

75.882

66.866

60.592

49.988

51.526

53.804

58.096

67.394

---

---

|

[ : . ]

<Figure 13.2.1> Price of Crude Oil, Smoothing and Filtering

The N-point centered moving average of a time series refers to the average of N data

from a single point in time. For example, in crude oil price data, the value of the

five-point moving average for a specific year is the average of the data for two years

before the specific year, that year, and the data for the next two years. Expressed as

an expression, if \(M_t\) is a moving average in time \(t\), the 5-point centered moving

average is as follows:

$$

M_t = \frac{Y_{t-2} \,+\, Y_{t-1} \,+\, Y_{t} \,+\, Y_{t+1} \,+\, Y_{t+2} } {5 }

$$

For example, the 5-point centered moving average for 1989 is as follows.

\(\qquad M_{1989} \,=\, \frac {Y_{1987} + Y_{1988} +Y_{1989} + Y_{1990} + Y_{1991} } {5 } \)

\( \qquad \qquad \quad =\, \frac {16.74 + 17.12 + 21.84 + 28.48 + 19.15} {5} \,=\, 20.6660 \)

[Table 13.2.2] shows the values of all 5-points centered moving averages obtained in this way and <Figure 13.2.1> is the graph of 5-points moving average. Note that the moving averages for the first two years and the last two years cannot be obtained here. It can be seen that the graph of the moving average is better for grasping the long-term trend than the graph of the original data because short-term fluctuations are removed.

The choice of a value N for the N-point moving average is important. A large value of N

will provide a smoother moving average, but it has the disadvantage of losing more points

at both ends and insensitive to detecting important trend changes. On the other hand,

if you choose small N, you will lose less data at both ends, but you may not be able

to get the smoothing effect because you will not sufficiently eliminate short-term fluctuations.

In general, try a few values N to reflect important changes that should not be missed,

while achieving a smoothing effect and balancing the points not to lose too much at both ends.

If the value of N is an even number, there is a difficulty in obtaining a central moving average

with the same number of data on both sides of the base year. For example, the center of the

four-point moving average from 1987 to 1990 is between 1988 and 1989. If you denote this as

\(M_{1988.5}\), it can be calculated as follows:

\( \qquad M_{1988.5} \,=\, \frac {Y_{1987} + Y_{1988} +Y_{1989} + Y_{1990} } {4 }

\,=\, \frac {16.74 + 17.12 + 21.84 + 28.48 } {4} \,=\, 21.045 \)

The 4-point moving average obtained in this way is called a non-central 4-points moving average.

In the case of this even number N, the non-central moving average does not match the observation

year of the original data, which is inconvenient. In the case of this even number N, it is

calculated as the average of the noncentral moving average values of two adjacent non-central

moving averages. In other words, the central four-point moving average in 1989 is the average

of \(M_{1988.5}\) and \(M_{1989.5}\) as follows:

\( \qquad M_{1989} \,=\, \frac {M_{1988.5} \,+\, M_{1989.5} } {2 } \,=\, \frac {21.0450 \,+\, 21.6475 } {2} \,=\, 21.3463 \)

If the time series is quarterly or monthly, a 4-point central moving average or a 12-point central moving average is an average of one year, so it is often used to observe data without seasonality.

13.2.2 Exponential Smoothing

3-point moving average can be considered the weighted average of three data with each weight

\(\frac{1}{3}\) as follows:

$$

M_t \,=\, \frac{Y_{t-1} \,+\, Y_{t} \,+\, Y_{t+1} } {3 } \,=\, \frac{1}{3}Y_{t-1} \,+\, \frac{1}{3}Y_{t} \,+\, \frac{1}{3}Y_{t+1}

$$

When the weights are \(w_1 , w_2 , ... , w_n\), the weighted moving average \(M_t\) of the

time series is defined as follows:

$$

M_t \,=\, \sum_{i=1}^{n} w_i Y_{i}

$$

where \(n\) is the number of data, \(w_i \ge 0\) and \(\sum_{i=1}^{n} w_i = 1 \).

Various weighted averages with different weights can be used depending on the purpose.

Among them, a smoothing method that gives more weight to data closer to the present and

smaller weights as it is farther from the present is called exponential smoothing.

The exponential smoothing method is determined by an exponential smoothing constant \(\alpha\)

that has a value between 0 and 1. The exponentially smoothed data \(E_t\) is calculated as follows:

\( \qquad E_{1} \,=\, \alpha \,Y_{1} \,+\, (1- \alpha)\, E_{0} \)

\( \qquad E_{2} \,=\, \alpha \,Y_{2} \,+\, (1- \alpha)\, E_{1} \)

\( \qquad E_{3} \,=\, \alpha \,Y_{3} \,+\, (1- \alpha)\, E_{2} \)

\( \qquad \cdots \)

\( \qquad E_{t} \,=\, \alpha \,Y_{t} \,+\, (1- \alpha)\, E_{t-1} \)

Here, an initial value \(E_{0}\) is required, and \(Y_1\) is usually used a lot, and the average

value of the data can also be used. The exponentially smoothed value \(E_t\) at the point in time

\(t\) gives weight \(\alpha\) to the current data, and the \(1-\alpha\) weight to the previous

smoothed data is given. The exponentially smoothed value \(E_t\) can be represented with

the original data \(Y_t\) as follows:

$$

E_t \,=\, \alpha Y_t + \alpha (1-\alpha) Y_{t-1} + \alpha(1-\alpha)^2 Y_{t-2} + \cdots + \alpha(1-\alpha)^{t-2} Y_2 + \alpha(1-\alpha)^{t-1} Y_1 + (1-\alpha)^t E_0

$$

Therefore, the exponential smoothing method uses all data from the present and the past, but gives

the current data the highest weight α, and gives a lower weight as the distance from the present time increases.

Exponential smoothing of the crude oil price in [Table 13.2.1] with the initial value

\(E _{1986} = Y _{1987} \) and exponential smoothing constant \(\alpha\) = 0.3 is as follows.

\( \qquad E_{1986} \,=\, E_{1987} = 16.74 \)

\( \qquad E_{1987} \,=\, 0.3 \,Y_{1987} \,+\, (1- 0.3)\, E_{1986} \,=\, (0.3)(16.74)+(0.7)(16.74)=16.74 \)

\( \qquad E_{1988} \,=\, 0.3 \,Y_{1988} \,+\, (1- 0.3)\, E_{1987} \,=\, (0.3)(17.12)+(0.7)(16.74)=16.854 \)

All data exponentially smoothed with \(\alpha\) = 0.3 are given in [Table 13.2.2]. It can be seen that,

in the exponential smoothing method, there is no loss of data at both ends, unlike the moving average method.

The crude oil price time series and exponentially smoothed data are shown in <Figure 13.2.2>.

It can be seen that the smoothed data are not significantly different from the original data.

If the value of \(\alpha\) is small, more weight is given to the past data than to the present,

making it less sensitive to sudden changes in the present data. Conversely, the closer the value of

\(\alpha\) is to 1, that is, the more weight is given to the current data, the more the smoothed data

resembles the original data, and the smoothing effect disappears.

[Table 13.2.2] Price of Crude Oil and Exponential Smoothing with α =0.3

| Year |

Price of Oil |

Exponential Smoothing

α=0.3 |

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

|

16.74

17.12

21.84

28.48

19.15

19.49

14.19

17.77

19.54

25.90

17.65

12.14

25.76

26.72

19.96

31.21

32.51

43.36

61.06

60.85

95.95

44.60

79.39

91.38

98.83

91.83

98.17

53.45

37.13

53.75

60.46

45.15

61.14

48.52

75.21

106.95

|

16.740

16.854

18.350

21.389

20.717

20.349

18.501

18.282

18.659

20.832

19.877

17.556

20.017

22.028

21.408

24.348

26.797

31.766

40.554

46.643

61.435

56.385

63.286

71.714

79.849

83.443

87.861

77.538

65.416

61.916

61.479

56.580

57.948

55.120

61.146

74.888

|

13.2.3 Filtering by Moving Median

The N-point

centered moving median of a time series refers to the median of N data from a single point

in time \(t\). For example, in crude oil price data, the value of a five-point moving median for a specific

year is the median of data for two years before a certain year, that year, and data for two years thereafter.

If data are denoted by \(Y_{t-2} ,Y_{t-1} , Y_{t} , Y_{t+1} , Y_{t+2} \), and the data are sorted from

smallest to largest, and expressed as \(Y_{(t-2)} ,Y_{(t-1)} , Y_{(t)} , Y_{(t+1)} , Y_{(t+2)} \),

the median value is \(Moving Median_t \,=\, Y_{(t)}\).

For example, the 5-point central moving median in 1989 for crude oil prices in [Table 13.2.3] is as follows:

\(\qquad MovingMedian_{1989} \,=\, median \{ Y_{1987} , Y_{1988} ,Y_{1989} , Y_{1990} , Y_{1991} \} \)

\(\qquad \qquad \qquad \qquad \qquad \;\;\;=\, median \{16.74, 17.12 , 21.84 , 28.48,19.15 \} \,=\, 19.15 \)

[Table 13.2.3] and <Figure 13.2.3> show all the five-point moving median values obtained in this way and their graphs. Note that the moving median for the first two years and the last two years are not available here. Because the centered moving medians remove extreme values, it is called a filtering and the time series is much smoother than the original data.

[Table 13.2.3] Price of Crude Oil and 5-point Centered Moving Median

| Year |

Price of Oil |

5-point Centered Moving Median |

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

|

16.74

17.12

21.84

28.48

19.15

19.49

14.19

17.77

19.54

25.90

17.65

12.14

25.76

26.72

19.96

31.21

32.51

43.36

61.06

60.85

95.95

44.60

79.39

91.38

98.83

91.83

98.17

53.45

37.13

53.75

60.46

45.15

61.14

48.52

75.21

106.95

|

19.15

19.49

19.49

19.15

19.15

19.49

17.77

17.77

19.54

25.76

19.96

25.76

26.72

31.21

32.51

43.36

60.85

60.85

61.06

79.39

91.38

91.38

91.83

91.83

91.83

53.75

53.75

53.45

53.75

53.75

60.46

61.14

|

If the value of N is an even number, there is a difficulty in obtaining the central moving median having

the same number of data on both sides of the base year. For example, the center of the four-point moving

median from 1987 to 1990 is between 1988 and 1989. If you denote this as \(Median_{1988.5}\), it can be

calculated as follows:

\(\qquad MovingMedian_{1988.5} \,=\, median \{Y_{1987} , Y_{1988} , Y_{1989} , Y_{1990} \} \)

\(\qquad \qquad \qquad \qquad \qquad \quad \;\;=\, median \{16.74 , 17.12 , 21.84 , 28.48 \} \,=\, \frac {17.12 +21.84} {2} = 19.48 \)

The 4-point moving median obtained in this way is called the non-central 4-point moving median.

As such, the non-central moving average in the case of this even number N does not match the

observation year of the original data, which is inconvenient. In the case of this even number,

it is calculated as the average of the values of the two non-central moving medians that are

adjacent to each other. In other words, the central four-point moving median in 1989 is the mean of

\(MovingMedian_{1988.5}\) and \(MovingMedian_{1989.5}\).

13.3 Transformation of Time Series

Time series can be viewed by drawing the raw data directly, but in order to examine various characteristics, change in percentage increase or decrease is examined, and an index that is a percentage with respect to base time is alse examined. In addition, in order to examine the relation of the previous data, it is compared with a time lag or converted into horizontal data using the difference. When the variance of the time series increases with time, it is sometimes converted into a form suitable for applying the time series model by using logarithmic, square root, or Box-Cox transformation.

13.3.1 Percentage Change

A. Percent Change

In a time series, you can examine the increase or decrease of a value, but you can easily observe

the change by calculating the percentage increase or decrease. When the time series is expressed as

\(Y_1 , Y_2 , ... , Y_n\) , the percentage increase or decrease \(P_t\) compared to the previous data is as follows.

$$

P_{t} \,=\, \frac {Y _{t} - Y_{t-1}} {Y_{t-1}} \times 100 , \quad t=2,3, ... , n

$$

[Table 13.3.1] shows the number of houses in Korea from 2010 to 2020, and <Figure 13.3.1> shows

the percentage increase or decrease compared to the previous data. Looking at this rate of change,

it can be easily observed that the original time series has an overall increasing trend, but the rate

of change of the previous year has many changes. In other words, it can be observed that there was a

2.23% increase in the number of houses in 2014 compared to the previous year, and a 2.48% increase

in the number of houses in 2018 as well.

\(\qquad P_{2014} \,=\, \frac{19161.2 - 18742.1} {18742.1} \times 100 \,=\, 2.23 \)

[Table 13.3.1] Number of Houses in Korea and Percent Change (Korea National Statistical Office, unit 1000)

| Year |

Number of Houses |

% change |

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

|

17738.8

18082.1

18414.4

18742.1

19161.2

19559.1

19877.1

20313.4

20818.0

21310.1

21673.5

|

1.93

1.83

1.77

2.23

2.07

1.62

2.19

2.48

2.36

1.70

|

[ : ]

<Figure 13.3.1> Number of Houses in Korea and Transformation

B. Simple Index

Another way to use percentages to easily characterize changes over time is to calculate an index number.

An

index \(I_t\) is a number that indicates the change over time of a time series. The index number

\(Index_t\) of a time series at a certain point in time is the percentage of the total time series data

for a predetermined time point \(t_0\) called the base period.

$$

Index_{t} \,=\, \frac {Y _{t}} {Y_{t_0}} \times 100 , \quad t=1,2,..., n

$$

The most commonly used indices in the economic field are the price index and the quantity index.

For example, the consumer price index is a price index indicating the price change of a set of goods

that can reflect the total consumer price, and the index indicating the change in total electricity

consumption every year is the quantity index. There are several methods of calculating the index,

which are broadly divided into simple index number when the number of items represented by the index is one, and composite index number when there are several as in the consumer price index.

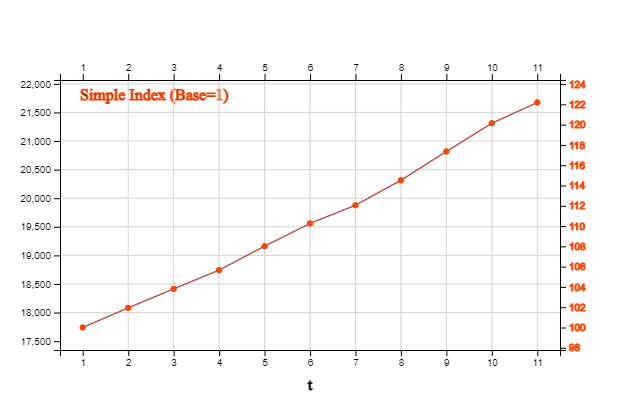

[Table 13.3.2] is a simple index for the number of houses in Korea from 2010 to 2020, with the base

time being 2010. If you look at the figure for the index, you can see that in this case, there is no significant change from the original time series and trend. It can be seen that there is a 22.18% increase in the number of houses in 2020 compared to 2010.

\(\qquad Index_{2020} \,=\, \frac{Y _{2020}} {Y_{2010}} \times 100 \,=\, \frac{21673.5} {17738.8} \times 100 \,=\, 122.18 \)

[Table 13.3.2] Simple Index of Number of Houses in Korea (Korea National Statistical Office, unit 1000)

| Year |

Number of Houses |

Simple Index

Base: 2010 |

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

|

17738.8

18082.1

18414.4

18742.1

19161.2

19559.1

19877.1

20313.4

20818.0

21310.1

21673.5

|

100.00

101.94

103.81

105.66

108.02

110.26

112.05

114.51

117.36

120.13

122.18

|

C. Composite Index

Composite index is a method in which the change in price or quantity of several goods is set at a specific time point as the base period, and then the data at each time point is calculated as a percentage value compared to the base period. An example of the most used composite index is the consumer price index, which reflects price fluctuations of about 500 products in Korea that affect consumer prices. Other commonly used composite indices include the comprehensive stock index, which examines the price fluctuations of all listed stocks traded in the stock market.

For the composite index, a weighted composite index that is calculated by weighting the price of each

product with the quantity consumed is often used. When calculating such a weighted composite index,

the case where the quantity consumption at the base time is used as a weight is called the

Laspeyres method, and the case where the quantity consumption at the current time is used

as the weight is called the Paasche method. In general, the Laspeyres method of weighted composite index is widely used, and the consumer price index is a representative example. The price index of the Paasche method is used when the consumption of goods used as weights varies greatly over time, and can be used only when the consumption at each time point is known. It is expensive to examine the quantity consumption at each point in time.

Assuming that \(P_{1t} , \cdots , P_{kt} \) are the prices of \(k\) number of products at the time point \(t\),

and \(Q_{1t_0} , \cdots , Q_{kt_0} \) are the quantities of each product consumpted at the base time,

the formula for calculating each composite index is as follows:

\( \qquad \text{Laspeyres Index:} \quad Index_t \,=\, \frac { Q_{1t_0} P_{1t} + \cdots + Q_{kt_0} P_{kt} } {Q_{1t_0} P_{1t_0}+ \cdots + Q_{kt_0} P_{kt_0} } \times 100 \)

\( \qquad \text{Paasche Index:} \qquad Index_t \,=\, \frac { Q_{1t} P_{1t} + \cdots + Q_{kt} P_{kt} } {Q_{1t} P_{1t_0} + \cdots + Q_{kt} P_{kt_0} } \times 100 \)

The data in [Table 13.3.3] shows the price and quantity of three metals by month in 2020.

[Table 13.3.3] Composite Index of three Metal Prices($/ton) and Production Quantity (ton)

Month |

Copper

Price Quantity |

Metal

Price Quantity |

Lead

Price Quantity |

Laspeyres Paasche |

1

2

3

4

5

6

7

8

9

10

11

12

|

1361.6 100.7

1399.0 95.1

1483.6 104.0

1531.6 95.6

1431.2 103.3

1383.8 106.9

1326.8 95.9

1328.8 96.7

1307.8 95.7

1278.4 89.1

1354.2 100.5

1305.2 96.9

|

213 4311

213 4497

213 5083

213 5077

213 5166

213 4565

213 4329

213 4057

213 3473

213 3739

213 3817

213 3694

|

530.0 46.1

520.0 47.0

529.0 51.0

540.0 23.0

531.0 26.5

580.0 13.5

642.8 27.4

602.6 25.8

513.6 20.5

480.8 24.6

528.4 21.5

462.2 27.9

|

100.00 100.00

100.31 100.28

101.13 101.01

101.63 101.35

100.65 100.57

100.42 100.27

100.16 99.98

100.00 99.87

99.43 99.38

99.01 99.07

99.92 99.92

99.18 99.21

|

In [Table 13.3.3], the Laspeyres index for the data for February with January as the base time is as follows.

\( \qquad Index_t \,=\, \frac { Q_{1t_0} P_{1t} + \cdots + Q_{kt_0} P_{kt} } {Q_{1t_0} P_{1t_0}+ \cdots + Q_{kt_0} P_{kt_0} } \times 100

\,=\, \frac {(100.7)(1399.0)+(4311)(213)+(46.1)(520) } {(100.7)(1361.6)+(4311)(213)+(46.1)(530) } \,=\, 100 .31 \)

Similarly, Paasche index is as follows:

\( \qquad Index_t \,=\, \frac { Q_{1t} P_{1t} + \cdots + Q_{kt} P_{kt} } {Q_{1t} P_{1t_0} + \cdots + Q_{kt} P_{kt_0} } \times 100

\,=\, \frac {(95.1)(1399.0)+(4497)(213)+(47.0)(520) } {(95.1)(1361.6)+(4497)(213)+(47.0)(530) } \,=\, 100.28 \)

In [Table 13.3.3], it can be seen that the production quantity of iron and lead in the last 4 quarters is significantly different from the production quantity in January, which is the base time. In this way, when the quantity fluctuates greatly and the quantity at each time is known, the Pasche index can be said to be the best index because it appropriately reflects the price change at that time.

13.3.2 Time Lag and Difference

A. Time Lag

In a time series, current data can usually be related to past data.

Lag means a transformation for

comparing data of the present time and observation values at one time point or a certain past time point.

That is, when the observed time series is \(Y_1 , Y_2 , ... , Y_n\), the time series with lag 1 becomes

\( - , Y_1 , Y_2 , ... , Y_{n-1}\) . Note that, in case of lag k, there are no data for the first \(k\) number than the original data.

The correlation coefficient between the time lag data and the raw data is called the

autocorrelation coefficient.

If the average of time series is \(\small \overline Y\) , the k-lag autocorrelation \(r_k\) is defined as follows:

$$ \small

r_k = \frac { \sum_{t = k+1}^ n (Y_t - \overline Y ) (Y_{t-k} - \overline Y ) } { \sum _{t =1}^n (Y_t - \overline Y )^2 }, \quad k=0, 1, 2, ..., n-1

$$

\(r_1 , r_2 , ... , r_k \) are called an autocorrelation function and are used to determine a time series model.

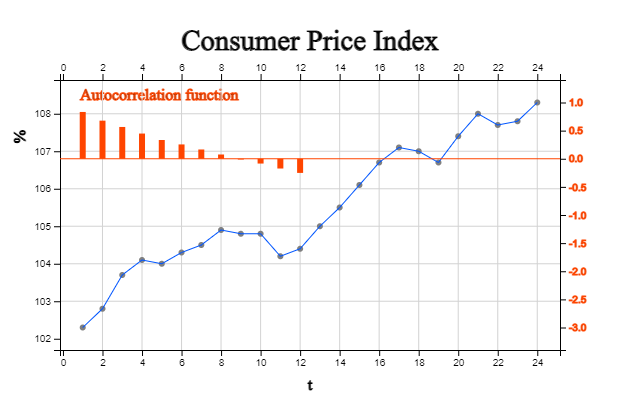

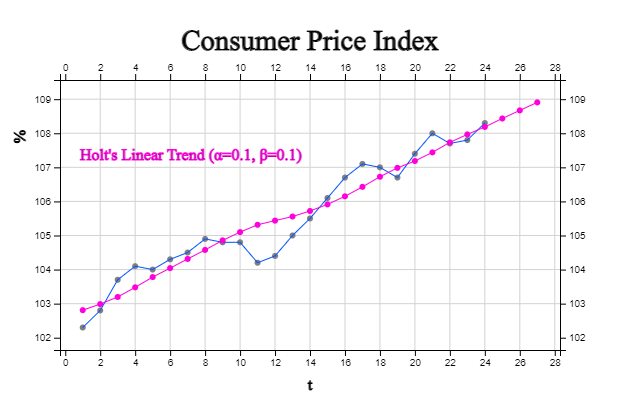

[Table 13.3.4] shows the monthly consumer price index for the past two years and time lag 1 to 12 for this data, and the autocorrelation coefficients are shown in [Table 13.3.5]. <Figure 13.3.3> shows the original time series and the autocorrelation function.

[Table 13.3.4] Monthly Consumer Price Index and Time Lag 1, Lag 2, ... Lag 12

| t |

Year.Month |

CPI |

lag 1 |

lag 2 |

... |

lag 12 |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

|

2020.01

2020.02

2020.03

2020.04

2020.05

2020.06

2020.07

2020.08

2020.09

2020.10

2020.11

2020.12

2021.01

2021.02

2021.03

2021.04

2021.05

2021.06

2021.07

2021.08

2021.09

2021.10

2021.11

2021.12

|

102.3

102.8

103.7

104.1

104.0

104.3

104.5

104.9

104.8

104.8

104.2

104.4

105.0

105.5

106.1

106.7

107.1

107.0

106.7

107.4

108.0

107.7

107.8

108.3

|

102.3

102.8

103.7

104.1

104.0

104.3

104.5

104.9

104.8

104.8

104.2

104.4

105.0

105.5

106.1

106.7

107.1

107.0

106.7

107.4

108.0

107.7

107.8

|

102.3

102.8

103.7

104.1

104.0

104.3

104.5

104.9

104.8

104.8

104.2

104.4

105.0

105.5

106.1

106.7

107.1

107.0

106.7

107.4

108.0

107.7

|

...

|

102.3

102.8

103.7

104.1

104.0

104.3

104.5

104.9

104.8

104.8

104.2

104.4

|

[Table 13.3.5] Autocorrelation Function

| time |

autocorrelation |

1

2

3

4

5

6

7

8

9

10

11

|

0.8318

0.6772

0.5651

0.4479

0.3333

0.2547

0.1647

0.0755

-0.0143

-0.0854

-0.1737

|

B. Differencing

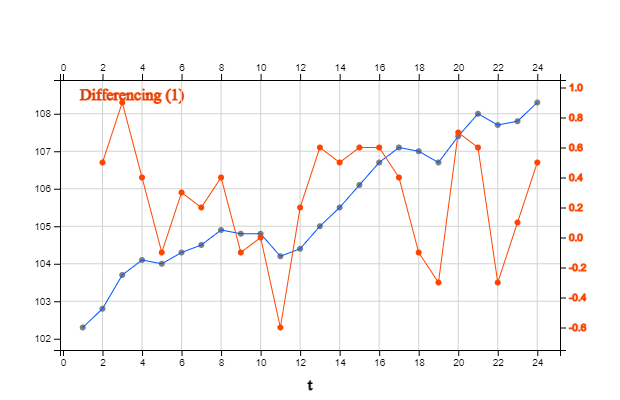

Since the price index in [Table 13.3.4] has a linear trend, a model for this trend can be built,

but in some cases, a model can be created by changing the time series to a horizontal trend.

The way to transform a linear trend into a horizontal trend is to use a

differencing.

When the time series is \(Y_1 , Y_2 , ... , Y_n \), the first order difference \(▽ Y_t\) is as follows:

$$

▽ Y_t \,=\, Y_t \,-\, Y_{t-1}, \quad t=2,3,...,n

$$

If the raw data is a linear trend, the first-order differencing of time series is a horizontal

time series because it means a change in slope. If we make differencing on the first-order difference \(▽ Y_t\),

it becomes the second-order difference as follows:

$$

▽^2 Y_t \,=\, ▽Y_t \,-\, ▽Y_{t-1} \,=\, ( Y_t \,-\, Y_{t-1} ) - ( Y_{t-1} \,-\, Y_{t-2}), \quad t=3,4,...,n

$$

If the raw data has a trend with a quadratic curve, the second-order differencing of time series becomes a horizontal time series.

<Figure 13.3.4> shows the first order differencing of [Table 13.3.4] time series and it becomes horizontal series.

13.3.3 Mathematical Transformation

If the original data of the time series is used as it is, modeling may not be easy or it may not satisfy various assumptions. In this case, we can fit the model we want by performing an appropriate functional transformation, such as log transformation. The functions commonly used for mathematical transformations are as follows.

\( \qquad \text{Log function } \qquad\qquad \qquad W = log(Y) \)

\( \qquad \text{Square root function} \qquad\quad W = \sqrt(Y) \)

\( \qquad \text{Square function } \qquad\quad \qquad W = Y^2 \)

\( \qquad \text{Box-Cox Transformation} \quad \; W = \frac {Y^p - 1 }{p} \) if p ≠ 0, else log(Y)

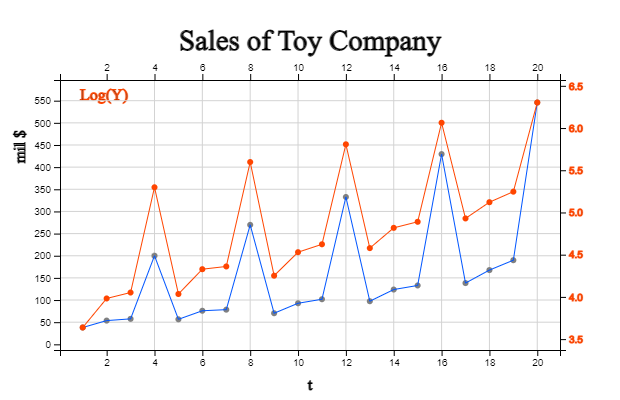

[Table 13.3.6] is a toy company's quarterly sales, and <Figure 13.3.5> is a

diagram of this data. It is a seasonal data by quarter, but, as time goes on,

dispersion of sales increases over time. It is not easy to apply a time series model

to data with this increasing dispersion over time. In this case, log transformation

\(W = log(Y)\) can reduce the dispersion as time increases, as shown in

<Figure 13.3.5>, so that a model can be applied. After predicting by applying

the model to log-transformed data, exponential transformation \(Y = exp(W)\) is

performed again to predict the raw data.

[Table 13.3.6] Quarterly Sales of a Toy Company (unit million $)

| time |

Year |

Sales |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

|

2017 Quarter 1

2017 Quarter 2

2017 Quarter 3

2017 Quarter 4

2018 Quarter 1

2018 Quarter 2

2018 Quarter 3

2018 Quarter 4

2019 Quarter 1

2019 Quarter 2

2019 Quarter 3

2019 Quarter 4

2020 Quarter 1

2020 Quarter 2

2020 Quarter 3

2020 Quarter 4

2021 Quarter 1

2021 Quarter 2

2021 Quarter 3

2021 Quarter 4

|

38.0

53.6

57.5

200.0

56.5

75.8

78.3

269.7

70.2

92.7

101.8

332.6

97.3

123.7

132.9

429.4

138.3

167.6

189.9

545.9

|

The square root transform is used for a similar purpose to the log transform, and the square transform can be used when the variance decreases with time. The Box-Cox transform is a general transformation.

13.4 Regression Model and Forecasting

If there is a trend factor that shows a continuous increase or decrease in the time series,

the regression model learned in Chapter 12 can be applied. For example, if the time series

shows a linear trend, the linear regression model is applied with the time series as

the observation values of the random variable \(Y_1 , Y_2 , ... , Y_n\) and time

as 1, 2, ... , \(n\) as follows.

$$

Y_t \,=\, \beta_0 \,+\, \beta_1 t \,+\, \epsilon_t

$$

Here \(\epsilon_t \) is the error term with mean 0 and variance \(\sigma^2\).

A characteristic of the linear model is that it increases by a slope \(\beta_1\)

of a certain magnitude over time.

When the estimated regression coefficients are \(\beta_0 , \beta_1\), the validity test

of the linear regression model is the same as the method described in Chapter 12.

The standard error of estimate and coefficient of determination are often used.

In a linear trend model, \(\sigma\) represents the degree to which observations

can be scattered around the estimated regression line at each time point. As an estimate

of this \(\sigma\), the following standard error is used.

$$

s \,=\, \sqrt { \frac{1} {n-2} \sum_{t=1}^n ( Y_t - {\hat Y}_t )^2 }

$$

A smaller standard error \(s\) value indicates that the observed values are close to

the estimated regression line, which means that the regression line model is well fitted.

The coefficient of determination is the ratio of the regression sum of squares, RSS, which is explained out of the total sum of squares, TSS.

$$

R^2 \,=\, \frac{RSS}{TSS}

$$

The value of the coefficient of determination is always between 0 and 1, and the closer the value is to 1, the more dense the samples are around the regression line, which means that the estimated regression equation explains the observations well.

As explained in Chapter 12, since it is difficult to determine the absolute criteria for adequacy of

the standard error or the coefficient of determination, a hypothesis test is used to determine whether

the trend parameter \(\beta_1\) is zero or not.

\(\small \qquad \text{Hypothesis: } \qquad \,\, H_0 : \beta_1 = 0, H_1: \beta_1 \ne 0\)

\(\small \qquad \text{Test statistic:} \qquad t_{obs} = \frac {{\hat \beta}_1 } { SE ({{\hat \beta}_1 }) } \) ,

Here, \( SE( \hat{ \beta_1} ) \,=\, \frac{ s} { \sqrt { \sum_{i=1}^ n (i - \overline t )^2 } } \)

\(\small \qquad \text{Rejection region:} \quad If \,\; |t_{obs}| \,>\, t_{n-2,\alpha/2}, \,\,reject\,\, H_0 \) with significance level \(\alpha\)

If the null hypothesis \(H_0\) is not rejected, the model cannot be considered valid.

The assumption for error \(\epsilon_t\) is tested using the residual, which is the difference between the observed time series value and the predicted value which is called residual analysis. Residual analysis usually examines whether assumptions about error terms such as independence and equal variance between errors are satisfied by drawing a scatter plot of the residuals over time or a scatter plot of the residuals and predicted values. In the scatterplots, if the residuals do not show a specific trend around 0 and appear randomly, it means that each assumption is valid. To examine the normality assumption of the error term, draw a normal probability plot of the residuals, and if the points on the figure show the shape of a straight line, it is judged that the assumption of the normal distribution is appropriate.

If the linear regression model is suitable, the predicted value

\({\hat Y}_{t_0} \,=\, {\hat \beta}_0 \,+\, {\hat \beta}_1 \cdot t_0 \) at the time point \(t_0\)

can be interpreted as a point estimate for the mean of the random variable \(Y_{t_0}\) at the time point,

and the confidence interval for the mean of \({\hat Y}_{t_0}\) at this time \(t_0\) is as follows:

$$\small

{\hat Y}_{t_0} \,±\, t_{n-2,\alpha/2} \cdot SE ({\hat Y}_{t_0} ) \;\; where \;\, SE ( {\hat Y}_{t_0} ) \,=\, s \cdot \sqrt { \frac{1}{n} + \frac {(t_0 - \overline t )^2} { \sum_{i=1}^n (i - \overline t )^2 } }

$$

If the trend is in the form of a quadratic, cubic or higher polynomial, the following multiple linear regression model can be assumed.

\( \qquad \text{Quadratic} \qquad Y_t = \beta_0 + \beta_1 \cdot t + \beta_2 \cdot t^2 + \epsilon _t \)

\( \qquad \text{Cubic} \qquad \qquad Y_t = \beta_0 + \beta_1 \cdot t + \beta_2 \cdot t^2 + \beta_3 \cdot t^3 + \epsilon _t \)

The prediction method is similar to the above simple linear regression model.

If the trend is not a polynomial model as above, the following model can also be considered.

\( \qquad \text{Square root} \qquad Y_t = \beta_0 + \beta_1 \cdot \sqrt{t} + \epsilon _t \)

\( \qquad \text{Log} \qquad \qquad \quad \; Y_t = \beta_0 + \beta_1 \cdot log(t) + \epsilon _t \)

These models are the same as the linear regression model if \(\sqrt{t}\) or \(log(t)\)

are replaced with the independent variable X in the simple linear regression and the prediction method is similar.

In addition, the function types to which the linear regression model can be applied by transformation are as follows.

\( \qquad \text{Power} \qquad \qquad Y _{t} = \beta_{0} \cdot t ^{\beta _{1}} + \epsilon _{t} \)

\( \qquad \text{Exponential} \quad \;\; Y_t = \beta_0 \cdot e^ {( \beta_1 t)} + \epsilon _t \)

In the case of these two models, the parameters should be estimated using the nonlinear regression model,

but if the error term is ignored, the linear model can be estimated approximately as follows:

\( \qquad \text{Power} \qquad \qquad log(Y_{t}) = log(\beta_{0}) +{\beta _{1}} \cdot log(t) \)

\( \qquad \text{Exponential} \quad \;\; log(Y_t) = log(\beta_0) + \beta_1 \cdot t \)

Korea's GDP from 1986 to 2021 is shown in [Table 13.4.1]. <Figure 13.4.1> shows the application of

three regression models to this data. Among these models, the quadratic model has the largest value of

\(r^2\) = 0.9591, so it can be said that the time series is the most suitable model. However, additional validation of the model is required.

[Table 13.4.1] GDP of Korea

| Year |

GDP (billion $) |

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

|

330.65

355.53

392.67

463.62

566.58

610.17

569.76

383.33

497.51

576.18

547.66

627.25

702.72

793.18

934.9

1053.22

1172.61

1047.34

943.67

1143.98

1253.16

1278.43

1370.8

1484.32

1465.77

1499.36

1623.07

1725.37

1651.42

1638.26

|

[ : ]

<Figure 13.4.1> Korea GDP data and regression model

13.5 Exponential Smoothing Model and Forecasting

When the time series moves in a trend, the future can be predicted well with the regression model. However, it may not be appropriate to predict a time series that is dynamically moving hourly, daily, etc. In this case, a moving average model or an exponential smoothing model can be used. The time series model is explained into two cases where the trend is stationary and linear.

13.5.1 Stationary Time Series

A time series is called stationary if the statistical properties such as mean, variance and covariance

are consistent over time. When a time series is the observed values of random variables

\(Y_1 , Y_2 , ... , Y_T\), a stationary time series is the following model that changes around

a constant value \(\mu \).

$$

Y_i \;=\; \mu \;+\; \epsilon_i , \quad i=1,2,..., T

$$

Here \(\mu\) is unknown parameter and \(\epsilon_i\) is an error term which is independent with mean 0 and variance \(\sigma^2\).

A. Single Moving Average Model

In a stationary time series model, the estimated value of \(\mu\), \(\hat \mu\), is the mean of the data. .

$$

{\hat \mu} \;=\; \frac{1}{T} \sum_{ i=1}^T Y_i

$$

Using this model, the prediction after \(\tau\) time points ahead at the current time \(T\) denoted

as \({\hat Y}_{T+\tau}\), is as follows:

$$

{\hat Y}_{T+\tau} \;=\; \hat \mu, \quad \tau=1,2,...

$$

It is called a

simple average model.

The simple average model uses all observations until the current time. However, the unknown

parameter \(\mu\) may shift slightly over time, so it would be reasonable to give more weight

to recent data than to past data for prediction. If a weight \(\frac{1}{N}\) is given to only

the most recent \(N\) observations at the present time \(T\) and the weight of the remaining

observations is set to 0, the estimated value of \(\mu\) is as follows.

$$

{\hat \mu} \;=\; \frac{1}{N} \sum_{ i=T-N+1}^T Y_i \;=\; \frac{1}{N} ( Y_{T-N+1} + Y_{T-N+2} + \cdots + Y_T )

$$

This is called a single moving average at the time point \(T\) and it is denoted by \(M_T\).

The single moving average means the average of the \(N\) observations adjacent to the time point \(T\).

Notice

that \(Y_1, Y_2 , ... , Y_T\) are independent of each other by assumption, but \(M_1, M_2 , ... , M_T\)

are not independent of each other, but are correlated.

The value of the single moving average varies depending on the size of \(N\). When the value of \(N\)

is large, it becomes insensitive to the fluctuations of the original time series, so it changes

gradually, and when the value of \(N\) is small, it becomes sensitive to fluctuations. Therefore,

when the fluctuation of the original time series is small, it is common to set the small value of \(N\),

and when the fluctuation is large, it is common to set the value of large \(N\).

Using the single moving average model at the time point \(T\), the predicted value and the mean

and variance of the predicted value at the time point \(T+\tau\) are as follows.

\(\qquad {\hat Y}_{T+\tau} \;=\; M_T , \quad \tau=1,2, ... \)

\(\qquad E( {\hat Y}_{T+\tau} ) \;=\; E(M_T ) \;=\; \mu \)

\(\qquad Var({\hat Y}_{T+\tau} )\;=\; Var(M_t ) \;=\; \frac{ \sigma ^2} {N } \)

When the single moving average model is used, the 95% confidence interval estimation of the

predicted value is approximately as follows.

\(\qquad {\hat{Y}} _{T+ \tau } \;±\; 1.96 \sqrt {Var( {\hat{Y}} _{T+ \tau } )} \)

\(\qquad M_{T} \;±\; 1.96 \sqrt{ \frac{MSE} {N} } \)

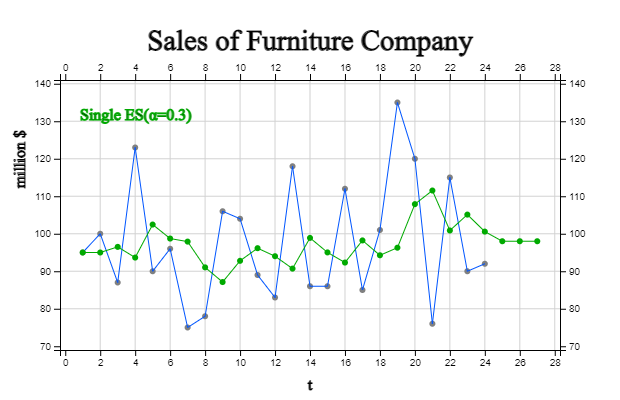

The monthly sales for the last two years of a furniture company are as shown in [Table 13.5.1],

and the residual between the raw data and the predicted value of one point in time was calculated

by obtaining a six-point moving average. <Figure 13.5.1> shows the time series for this.

This time series fluctuates up and down based on approximately 95, and such a time series is

called a stationary time series.

When \(N\) = 6, the moving average for the first 5 time points cannot be obtained.

The moving average at time 6 is as follows:

$$

M_6 \;=\; \frac{95+100+87+123+90+96} {6} \;=\; 98.50

$$

Therefore, one time prediction at time 6 becomes \({\hat Y}_{6+1} = 98.50 \) and the residual

at time 7 is as follows:

$$

e_{7} \;=\; Y_{7} \;-\; {\hat{Y}}_{6+1} \;=\; 75-98.50 \;=\; -23.50

$$

In the same way, the moving average of the remaining time points, the predicted values after one time point, and the residuals are as shown in [Table 13.5.1], so the mean square error is as follows:

$$

{ MSE} \;=\; \frac { \sum_{ i=7}^{ 24} ( Y_i \;-\; {\hat Y}_i )^{2} } {18} \;=\;331.22

$$

Sales for the next three months are the last moving average \(M_{24}\), and the 95% confidence

interval for the forecast is as follows:

\(\qquad {\hat Y}_{24+1} \;=\; {\hat Y}_{24+2} \;=\; {\hat Y}_{24+3} \;=\; M_{24} \;=\; 104.67 \)

\(\qquad M_T \;±\; 1.96 \sqrt \frac{MSE}{N } \)

\(\qquad 104.67 \;±\; 1.96 \sqrt \frac{331.22}{6} \)

\(\qquad [90.10, 119.23] \)

[Table 13.5.1] Montly Sales of a Furniture Company and 6-point Moving Average, One Time Forecast and Residuals

time

\(t\) |

Sales

(unit million $)

\(Y_t\) |

6-pt Moving

Average

\(M_t\) |

One Time

Forecast

\({\hat Y}_t\) |

Residual

\(e_t = Y_t - {\hat Y}_t\) |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

|

95

100

87

123

90

96

75

78

106

104

89

83

118

86

86

112

85

101

135

120

76

115

90

92

|

98.50

95.17

91.50

94.67

91.50

91.33

89.17

96.34

97.67

94.34

95.67

95.00

98.00

100.84

106.50

104.84

105.34

106.17

104.67

|

98.50

95.17

91.50

94.67

91.50

91.33

89.17

96.34

97.67

94.34

95.67

95.00

98.00

100.84

106.50

104.84

105.34

106.17

|

-23.50

-17.17

14.50

9.33

-2.50

-8.33

28.83

-10.33

-11.67

17.67

-10.67

6.00

37.00

19.17

-30.50

10.17

-15.33

-14.17

|

[ : ]

<Figure 13.5.1> Montly Sales of a Furniture Company and 6-point Moving Average and One Time Forecast

※ Moving average at initial period

Since the \(N\)-point single moving average cannot be obtained before the time point \(N\),

the prediction model cannot be applied. When there are many time series, this may not be

a big problem, but when the number of data is small, it can affect the prediction. In order to

solve this problem, the moving average at initial period can be obtained as follows until

the time point \(N-1\).

\(\qquad t=1 \qquad \quad M_1 = Y_1 \)

\(\qquad t=2 \qquad \quad M_2 = \frac{Y_1 + Y_2 } {2} \)

\(\qquad \cdots \)

\(\qquad t=N-1 \quad M_{N-1} = \frac{Y_1 + Y_2 + \cdots + Y_{N-1} } {N - 1} \)

B. Single Exponential Smoothing Model

In the single moving average model, the same weight \(\frac{1}{N}\) is given to only the latest

\(N\) observations, and the previous observations are completely ignored by setting the weight to 0.

The

single exponential smoothing method compensates for the shortcomings of the moving average

model by assigning weights to all observations when predicting future values from past observations,

but giving more weight to recent data. This single exponential smoothing model uses the value of the

exponential smoothing method as the predicted value.

The single exponential smoothing model calculates the weighted average of the exponential

smoothing estimator \({\hat \mu}_{t-1} \) at the immediately preceding time point and the observation

value \(Y_t\) at the time point \(t\). Assuming that the exponential smoothing estimated value

at the time point \(t\) is \(S_t \;=\; {\hat \mu}_t \) and \(\alpha\) is a real number

between 0 and 1, the single exponential smoothing value \(S_t\) is defined as follows:

\(\qquad S_1 \;=\; \alpha \;Y_1 \;+\; (1-\alpha) S_0 \)

\(\qquad S_2 \;=\; \alpha \;Y_2 \;+\; (1-\alpha) S_1 \)

\(\qquad \cdots \)

\(\qquad S_t \;=\; \alpha \;Y_t \;+\; (1-\alpha) S_{t-1} \)

Here, \(\alpha\) is called the smoothing constant, and the single exponential smoothing value

\(S_t\) is the weighted average value given the weight \(\alpha\) of the most recent observation

\(Y_t\) and the weight (1-\(\alpha\)) of the exponential smoothing value \(S_{t-1}\) at the time \(t-1\).

You can better understand the meaning of exponential smoothing if you write down the recursive

equation as follows:

\(\qquad S_t \;=\; \alpha \;Y_t \;+\; (1-\alpha) S_{t-1} \)

\(\qquad \;=\; \alpha \; Y_t + (1- \alpha )\;( \alpha Y_{t-1} + (1- \alpha ) S_{t-2} ) \)

\(\qquad \;=\; \alpha Y_t + \alpha (1- \alpha ) Y_{t-1} + (1- \alpha )^2 S_{t-2} \)

\(\qquad \;=\; \alpha Y_t + \alpha (1- \alpha ) Y_{t-1} + \alpha(1- \alpha )^2 Y_{t-2} \;+\cdots\; + \alpha (1- \alpha )^{(t-1)} Y_1 +(1- \alpha )^t S_0 \)

In other words, for the single exponential smoothing value \(S_t\), the most recent observation

\(Y_t\) is given a weight \(\alpha\), and the next most recent observation is given \(\alpha(1-\alpha)\),

the next is \(\alpha(1-\alpha)^2\) and so on, a gradually smaller weight. Therefore,

if the size of \(\alpha\) is small, the current observation value is given a small weight,

and the exponential smoothing value is insensitive to the fluctuations of the time series.

if the size of \(\alpha\) is large, the current observation value is given a large weight,

and the exponential smoothing value is sensitive to the fluctuations of the time series.

In general, a value between 0.1 and 0.3 is often used as the value of \(\alpha\).

In order to obtain a single exponential smoothing value, an initial smoothing value

\(S_0\) is required, and the first observation value or the sample average of several

initial data or the overall sample average can be used. The exponential smoothing method

has the advantage of being less affected by extreme point or intervention than the ARIMA model

and easy to use, although the selection of the smoothing constant is arbitrary and

it is difficult to obtain a prediction interval.

The predicted value, average and variance of the predicted value at the time point \(T+\tau\) using the

single exponential smoothing model are as follows:

\(\qquad {\hat Y}_{T+\tau} \;=\;S_T \)

\(\qquad E( {\hat Y}_{T+\tau} )\;=\;E(S_T )\;=\; \mu \)

\(\qquad Var( {\hat{Y}}_{T+ \tau } )\;=\; Var(S_{T} )\;=\; \frac{\alpha } {2- \alpha } \sigma^{2} \)

Therefore, when the single exponential smoothing model is used, the 95% interval estimation in the predicted value is approximately as follows.

\(\qquad {\hat Y}_{T+\tau} \;±\; 1.96 \sqrt { Var ({\hat Y}_{T+\tau})} \)

\(\qquad S_{T} \;±\;1.96\; \sqrt { \frac{\alpha } {2- \alpha } MSE} \)

To the data of [Table 13.5.1], predict sales for the next three months by a single exponential

smoothing model with smoothing constant \(\alpha\) = 0.1. Lets use the first observed value

for the initial value of exponential smoothing, that is \(S_0 = Y_1 = 95\). The exponential smoothing value for the first three time series are as follows:

\(\qquad S_{1} \;=\;0.1\; \times \;Y _{1} \;+\;(1-0.1\;)\; \times \;S _{0} \;=\;\;0.1\; \times \;95\;+\;0.9\; \times \;95\;=\;95 \)

\(\qquad S_{2} \;=\;0.1\; \times\;Y_2 \;+\; (1-0.1\;)\;\times\; S_1 \;=\; \;0.1\;\times\;100\;+\;0.9 \;\times \;95 \;=\; 95.50 \)

\(\qquad S_{3} \;=\;0.1\; \times \;Y _{3} \;+\;(1-0.1\;)\; \times \;S _{2} \;=\;\;0.1\; \times \;87\;+\;0.9\; \times \;95.5\;=\;94.65 \)

\(\qquad \cdots \)

At each time point, the prediction after one point in time is as follows:

\(\qquad {\hat Y}_{0+1} \;=\; S_0 \;=\;95.00 \)

\(\qquad {\hat Y}_{1+1} \;=\; S_1 \;=\;95.00 \)

\(\qquad {\hat Y}_{2+1} \;=\; S_2 \;=\;95.50 \)

Hence the residuals using the above estimated values are as follows:

\(\qquad e_1 \;=\; Y_1\;-\;{\hat Y}_{0+1} \;=\; 95.00 - 95.00 \;=\; 0 \)

\(\qquad e_2 \;=\; Y_2\;-\;{\hat Y}_{1+1} \;=\; 100.00 - 95.00 \;=\; 5.00 \)

\(\qquad e_3 \;=\; Y_3\;-\;{\hat Y}_{2+1} \;=\; 87.00-95.50\;=\;-8.50 \)

In the same way, the single exponential smoothing of the remaining time points, the predicted values after one time point, and the residuals are as shown in [Table 13.5.2]. Therefore, the mean square error is as follows:

\(\qquad {MSE} \;= \; \frac{1}{24} \sum_{i=1}^{24} \; ( Y_i \;-{\hat Y}_i )^{2} \;=\;269.72 \)

In terms of mean square error, the MSE of the 6-point single moving average model is 331.22, so it can be said that the exponential smoothing model has better fit.

Sales for the next three months are the last moving average \(S_{24}\), and the 95% confidence interval for the forecast is as follows:

\(\qquad {\hat Y}_{24+1} \;=\; {\hat Y}_{24+2} \;=\; {\hat Y}_{24+3} \;=\; S_{24} \;=\; 98.66 \)

\(\qquad S_{T} \;±\; 1.96\; \sqrt { \frac{\alpha } {2- \alpha} } MSE \)

\(\qquad 98.66 \;±\; 1.96 \; \sqrt { \frac{0.1} {2-0.1} 269.72 } \)

\(\qquad [65.27, 132.05] \)

[Table 13.5.2] summarizes the above equations, and <Figure 13.5.2> shows the prediction after

one time point and the prediction for the next 3 months using the single exponential smoothing model with

\(\alpha\) = 0.1.

[Table 13.5.2] Exponential Smoothing with α = 0.1, One Time Forecast and Residual

time

\(t\) |

Sales

(unit million $)

\(Y_t\) |

Exponential

Smoothing

\(S_t\) |

One Time

Forecast

\({\hat Y}_t\) |

Residual

\(e_t = Y_t - {\hat Y}_t\) |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

|

95

100

87

123

90

96

75

78

106

104

89

83

118

86

86

112

85

101

135

120

76

115

90

92

|

95.00

95.50

94.65

97.48

96.74

96.66

94.50

92.85

94.16

95.15

94.53

93.38

95.84

94.86

93.97

95.77

94.70

95.33

99.29

101.36

98.83

100.45

99.40

98.66

|

95.00

95.00

95.50

94.65

97.48

96.74

96.66

94.50

92.85

94.16

95.15

94.53

93.38

95.84

94.86

93.97

95.77

94.70

95.33

99.29

101.36

98.83

100.45

99.40

|

0.00

5.00

-8.50

28.35

-7.48

-0.74

-21.66

-16.50

13.15

9.84

-6.15

-11.53

24.62

-9.84

-8.86

18.03

-10.77

6.30

39.67

20.71

-25.36

16.17

-10.45

-7.40

|

※ Initial value of exponential smoothing

Since the initial exponential smoothing value \(S_0\) at the time point \(t=1\) cannot be obtained,

the following three methods are commonly used.

1) The first observation, i.e., \(S_0 \;=\; Y_1\)

2) Partial average using the initial \(n\) observation values, i.e.,

\(\qquad S_0 \;=\; \frac{1}{n} ({Y_1 + Y_2 + \cdots + Y_n }) \)

3) The mean up to the entire time point \(T\), i.e.,

\(\qquad S_0 \;=\; \frac{1}{T} ({Y_1 + Y_2 + \cdots + Y_T }) \)

※ Initial smoothing constant

The same smoothing constant \(\alpha\) can be applied to all time series, but the following

method is also used to reduce the effect of the initial value \(S_0\).

\(\qquad \alpha_t \;=\; \frac{1}{t} , \quad until \; \alpha_t \; reaches\; \alpha \)

13.5.2 Linear Trend Time Series

A. Double Moving Average Model

In the previous section, we examined that the single moving average model can be applied

to a stationary time series. What would happen if the single moving average model was applied

to a time series with a linear trend? That is, for a time series with a linear trend

\(Y_t \;=\; \beta_0 \;+\; \beta_1 \cdot t \;+\; \epsilon _t \), the \(N\)-point single moving average

at time \(T\) is as follows:

$$

M_T \;= \; \frac{1}{N} ( Y_{T-N+1} \;+\; Y_{T-N+2} \;+\; \cdots \;+\; Y_T )

$$

The expected value can be shown as follows:

$$

E(M_T) \;=\; \beta_0 + \beta_1 T - \frac{N-1} {2} \beta_1

$$

That is, in the case of a linear trend model, it can be seen that the single moving average \(M_t\)

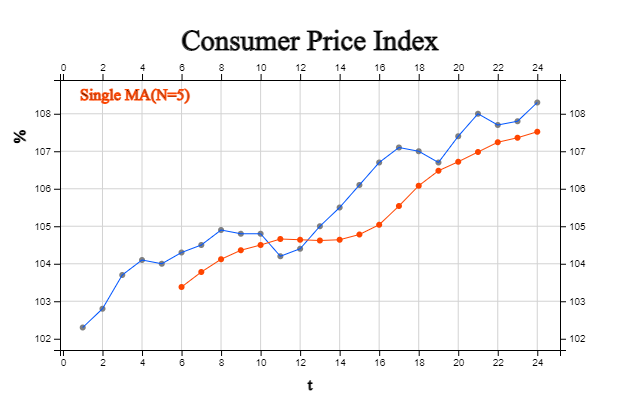

is biased by \(\frac{N-1}{2} \beta_1 \). For example, if the consumer price index with a linear trend

in [Table 13.5.3] is predicted after one point in time using the 5-point single moving average,

it is as shown in <Figure 13.5.3>. It can be seen that the predicted value using \(M_t\)

is under estimated value of the time series .

In the case of a linear trend, one way to eliminate the bias of the single moving average model

is the double moving average, which obtains the moving average again for the single moving average.

The \(N\)-point double moving average \(M_T^{(2)}\) at the time \(T\) and its expected value are

as follows:

$$

\begin{align}

M_T^{(2)} &\;=\; \frac{1}{N} (M_T \;+\; M_{T-1} \;+\; \cdots \;+\; M_{T-N+1}) \\

E(M_T^{(2)}) &\;=\; \beta_0 \;+\; \beta_1 T \;-\; (N-1) \beta_1

\end{align}

$$

Since \(E(M_T )\) and \(E(M_T ^{(2)} )\) have the same number of parameters, \(\beta_0 ,\;\beta_1 \)

can be estimated by solving the system of two equations as follows:

$$

\begin{align}

{\hat{\beta }}_{1} &\;=\; \frac{2}{N-1} \; (M_{T} \;-\; M_{T}^{(2)} ) \\

{\hat{\beta }}_{0} &\;=\; 2M_{T} \;-\; M_{T}^{(2)} \;-\; {\hat{\beta }}_{1} \;T\;

\end{align}

$$

Therefore, the predicted value at the time point \(T+\tau\) using the double moving average

at time \(T\) as follows:

$$

{\hat Y}_{T+\tau} \;=\; 2 M_T \;-\; {M_T ^{(2)}} \;+\; \tau \;\; (\frac {2}{N-1} ) \;\; (M_T\;-\; M_T^{(2)})

$$

Such a double moving average model can be said to be a kind of heuristic method. That is, although logical, it is not based on any optimization such as least squares method. However, it can be approximated by the least-squares method, which we will omit in this book.

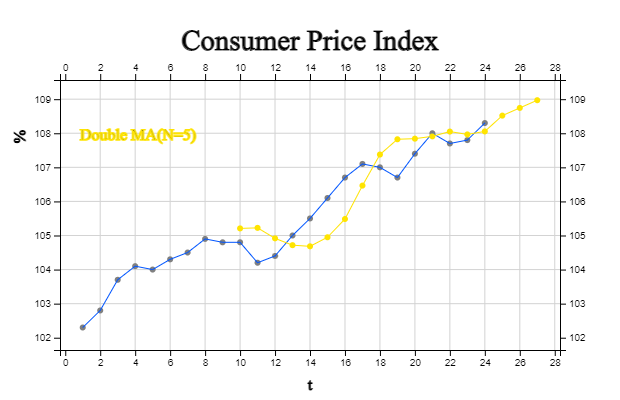

[Table 13.5.3] is a calculation table for predicting the consumer price index using the 5-point

double moving average model. Note that the third column is a 5-point single moving average \(M_T\),

but the single moving average cannot be calculated from time points 1 to 4. The fourth column

is the calculation of the 5-point double moving average \(M_t^{(2)}\), but the double moving average

cannot be calculated until 5 single moving averages have been calculated, that is, from time points

1 to 8. Using \(M_9\) and \(M_9^{(2)}\) to obtain the prediction after time 1 from time 9,

\({\hat Y}_{9+1}\) is as follows:

$$

\begin{align}

{\hat Y}_{9+1} &\;=\; 2M_9 \;- M_9^{(2)} \;+ 1 \;\; (\frac{2}{5-1}) \;\;(M_9\;-\;M_9 ^{(2)}) \\

&\;=\; 2 \times 104.50\;-104.028\;+1\;\; ( \frac{2}{5-1} ) \;\;(104.50\;-104.028)\;=\;105.2080

\end{align}

$$

The predicted values calculated in the same way are shown in the fifth column.

[Table 13.5.3] Double Moving Average of Consumer Price Index and One Time Forecast

time

\(t\) |

CPI

\(Y_t\) |

5-pt Single

Moving Average

\( M_t\) |

5-pt Double

Moving Average

\( M_t ^(2)\) |

One Time Forecast\({\hat Y}_{(t-1)+1}\) |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

|

102.3

102.8

103.7

104.1

104.0

104.3

104.5

104.9

104.8

104.8

104.2

104.4

105.0

105.5

106.1

106.7

107.1

107.0

106.7

107.4

108.0

107.7

107.8

108.3

|

103.38

103.78

104.12

104.36

104.50

104.66

104.64

104.62

104.64

104.78

105.04

105.54

106.08

106.48

106.72

106.98

107.24

107.36

107.52

107.84

|

104.028

104.284

104.456

104.556

104.612

104.668

104.744

104.924

105.216

105.584

105.972

106.36

106.70

106.956

107.164

107.388

|

105.2080

105.2240

104.9160

104.7160

104.6820

104.9480

105.4840

106.4640

107.3760

107.8240

107.8420

107.9100

108.0500

107.9660

108.0540

|

B. Holt Double Exponential Smoothing Model

Holt proposed a model for a linear time series \(Y_t \;=\; \beta_0 \;+\; \beta_1 \cdot t \;+\; \epsilon_t \)

which uses a smoothing constant for the level and a smoothing constant for the trend. This is

called

Holt's linear trend exponential smoothing model or two-parameters double exponential

smoothing model. Let \({\hat b}_0 \) and \({\hat b}_1 \) be the initial values of the intercept

and slope, and \(\alpha\) be the smoothing constant of the level and \(\gamma\) is the smoothing

constant of the trend. The predicted values \({\hat Y}_t\), level \({\hat \beta}_0 (t)\) and

trend \({\hat \beta}_1 (t)\) are as follows:

$$

\begin{align}

& \text{Predicted value:} \quad {\hat Y}_t \;=\; {\hat \beta}_0 (t-1) + {\hat \beta}_1 (t-1) \\

& \text{Level:} \qquad\qquad \; {\hat \beta}_{0}(t) \;=\; \alpha Y_t + (1-\alpha) {\hat Y}_t \\

& \text{Trend:} \qquad\qquad {\hat \beta}_{1}(t) \;=\; {\gamma} \{ {\hat \beta}_0 (t) - {\hat \beta}_0 (t-1) \} + (1-\gamma) {\hat \beta}_1 (t-1)

\end{align}

$$

That is, the level is the weighted average of the current observed value \(Y_t\) and the predicted value

\({\hat Y}_t\), and the trend is the weighted average of the level difference

\({\hat \beta}_0 (t) - {\hat \beta}_0 (t-1) \) between the time points \(t\) and \((t-1)\) and

the trend \({\hat \beta}_1 (t-1) \) at the time point \((t-1)\). For this model, initial values

of level \({\hat \beta}_0 (0) \) and slope \({\hat \beta}_1 (0) \) are required and the intercept

and slope of the simple regression analysis of all observed values are widely used as initial estimates.

Similar to the single exponential smoothing model, a value between 0.1 and 0.3 is often used

to determine the smoothing constants \(\alpha\) and \(\gamma\).

The predicted values for the time point \(T+\tau\) at time \(T\) using the trend exponential

smoothing model are as follows:

$$

{\hat Y}_{T+\tau} \;=\; {\hat Y}_T + \tau {\hat \beta}_1 (T)

$$

Such a trend exponential smoothing model is also a kind of heuristic method. That is, although logical, it is not based on any optimization such as least squares method.

The result of simple linear regression model to all data in [Table 13.5.4] is as follows:

$$

{\hat{Y}}_{t} =102.574 \;+\; 0.2344 \;\;t

$$

[Table 13.5.4] is a calculation table for predicting the consumer price index with the Holt

double exponential smoothing model using this initial values. The third column is the predicted

value of the level \({\hat \beta}_0 (t) \), the fourth column is the trend \({\hat \beta}_ (t) \),

and the fifth column is the prediction \({\hat Y}_t = {\hat \beta}_0 (t-1) + {\hat \beta}_1 (t-1) \)

obtained one time after each time point. Therefore, the forecast of the consumer price index for

the next three months is as follows:

$$

\begin{align}

& t=25 \qquad {\hat{Y}} _{24+1} \;=\; {\hat{Y}} _{24} \;+\; 1\; \times {\hat{\beta}} _{1} (24)\;=\;108.19 +0.237\;=\;108.42 \\

& t=26 \qquad {\hat{Y}} _{24+2} \;=\; {\hat{Y}} _{24} \;+\; 2\; \times {\hat{\beta}} _{1} (24)\;=\;108.19 + 2 \times0.237\;=\;108.66 \\

& t=27 \qquad {\hat{Y}} _{24+3} \;=\; {\hat{Y}} _{24} \;+\; 3\; \times {\hat{\beta}} _{1} (24)\;=\;108.19 + 3 \times0.237\;=\;108.90

\end{align}

$$

[Table 13.5.4] Forecasting using Holt Double Exponential Smoothing Model of Consumer Price Index

time

\(t\) |

CPI

\(Y_t\) |

Constant

\( {\hat \beta}_0 (t)\) |

Trend

\( {\hat \beta}_1 (t)\) |

One Time Forecast\({\hat Y}_{(t-1)+1}\) |

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

|

102.3

102.8

103.7

104.1

104.0

104.3

104.5

104.9

104.8

104.8

104.2

104.4

105.0

105.5

106.1

106.7

107.1

107.0

106.7

107.4

108.0

107.7

107.8

108.3

|

102.57

102.76

102.97

103.25

103.54

103.80

104.07

104.33

104.61

104.85

105.07

105.20

105.33

105.50

105.70

105.93

106.20

106.49

106.75

106.96

107.21

107.50

107.73

107.95

108.20

|

0.234

0.229

0.227

0.232

0.239

0.241

0.243

0.245

0.249

0.248

0.245

0.234

0.224

0.218

0.216

0.218

0.223

0.230

0.233

0.230

0.232

0.238

0.237

0.236

0.237

|

102.81

102.99

103.20

103.48

103.78

104.04

104.31

104.58

104.86

105.10

105.31

105.44

105.56

105.72

105.91

106.15

106.43

106.72

106.98